OPINION – Investing in Myself — An OPED About College Debt

Disclaimer: This article is an opinion piece. Any views or opinions represented in this piece are personal and belong solely to the article author and are not endorsed or representative of The Academy Chronicle, Mt. SAC ECA, or the West Covina Unified School District.

This year, I’m going to invest $50,000 in myself. And in another four years, I’m going to invest another $200,000. In between those years, I’ll be paying off interest on that $250,000. Except, I don’t know the return on this investment, and I’m making the first one at 17 years old. If you talk to any venture capitalists, it probably doesn’t sound like a great investment for a middle class 17 year old girl to make, but for the majority of us, we have too.

The average cost of attending a public university in California is $38,504 (without any financial aid), and “Over 70% of our California undergrads get an average of $18,000 in grants and scholarships to help with costs, including UC tuition, food and housing, transportation, books and supplies,” (UC Admissions). Quick math, $38,504 – $18,000 = $20,504. This number multiplied by four years…$82,016, for an undergraduate education. In a growing economy and higher employment expectations, having a bachelor’s degree has become a preliminary standard in certain fields.

I mean, I feel guilty buying a shirt that’s more than $30, or spending money on getting my nails done or buying boba. How am I supposed to spend over $80,000 on education that could’ve been free.

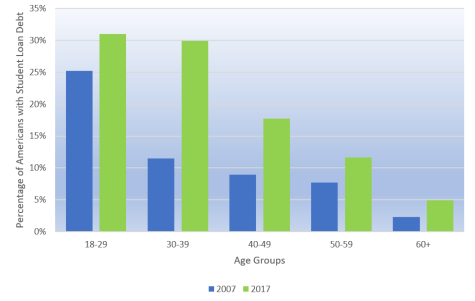

This sentiment is not uncommon, as more students encounter a “student debt loan crisis.” As more college students borrow money to pay for their college education, the debt that they accrue increases, but they continue to face “declining average wage values” out of college (Hanson). Regardless if students want to get an education, they may (unknowingly) sign away their lives to debt.

And among those most affected– children from low-income families, according to the National Student Clearinghouse Research Center, which reports “unprecedented” declines in the number of students from high-poverty or low-income high schools who immediately go on to higher education.

“We’re seeing a lot more people moving into the very unlucky group instead of the lucky group,” said Lleras-Muney. “That will be very bad for them personally. It will start showing up in their health, their likelihood of remaining in marriage — you name it.”

Now I’m not quite sure that marriage is a concern for me, but healthwise? I’d prefer if I wasn’t being mentally and physically impacted by a system that feeds off my career obligations. I don’t want to take out hundreds of thousands of dollars in loans, but if I do, I get to work in a field that I love. And supposedly, if you love what you do, you’ll never work a day in your life. But work is still work, and there’s no guarantee that I’ll be happy with my choices.

Although I’ve just spent a few hundred words being very concerned about the amount of debt that might be attached to my name, there’s something inside of me that still gets excited at the prospect of college. Even as I look at the housing crisis and skyrocketing rates of student loan debt, I still want that quintessential college experience. In my soul, I want to make friends, eat in a dining hall, explore my identity, take classes for fun, and learn to be an autonomous human being. Perhaps that idea speaks for itself more than my words ever will.

Your donation will support the student journalists of Mt. SAC Early College Academy. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Payton Zarceno is a senior at Mt. SAC Early College Academy and is a founding member of The Academy Chronicle. She has been part of the Friends for Progress...

Suchaya P • Mar 29, 2023 at 11:24 am

Great Article. Do not worry about debt, your dedication and great job will pay it off with no time. Go for it.